About General Insrance

General Insurance protects you from financial loss caused by unexpected events other than death (which comes under life insurance). It helps individuals, families, and businesses stay financially safe during emergencies.

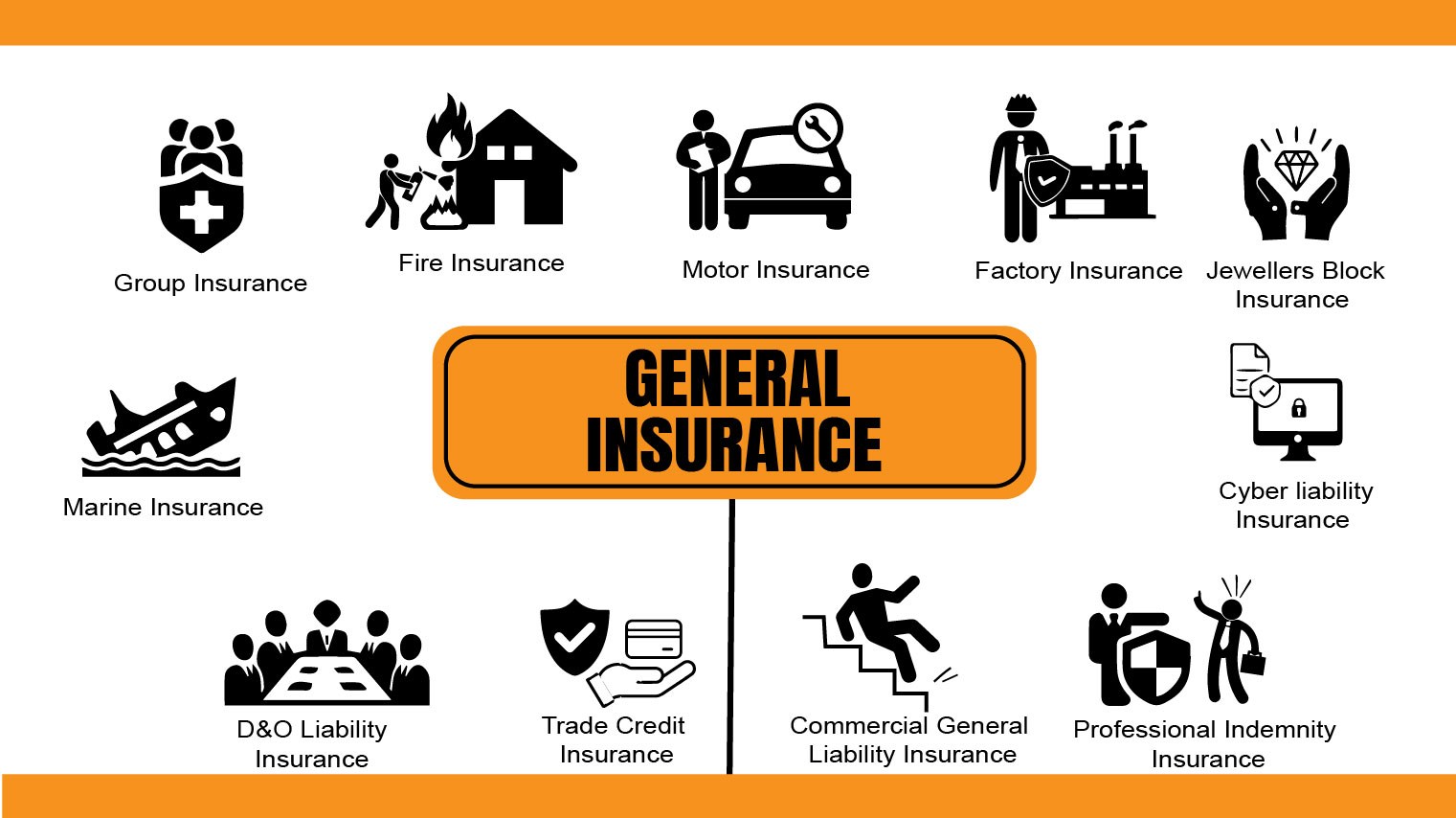

📌 What General Insurance Covers

🚗 Motor Insurance

-

Covers car, bike, truck damages

-

Accident repair, theft, fire

-

Mandatory in India

🏥 Health Insurance

-

Covers hospitalization & medical bills

-

Cashless treatment in network hospitals

-

Protects savings during medical emergencies

🏠 Home Insurance

-

Covers house & household items

-

Protection against fire, flood, theft, earthquake

✈️ Travel Insurance

-

Covers medical emergencies while traveling

-

Flight delays, lost baggage, passport loss

🏢 Commercial / Business Insurance

-

Fire, burglary, machinery breakdown

-

Liability and employee insurance

⭐ Key Features of General Insurance

✔️ Short-term policies (usually 1 year)

✔️ Covers accidents, losses, damages

✔️ Claim-based benefit (no maturity value)

✔️ Peace of mind during emergencies

❓ Why General Insurance Is Important

-

Sudden events can cause huge expenses

-

Helps avoid using savings or taking loans

-

Protects family, assets, and business

-

Legal requirement (Motor Insurance)

🆚 Life Insurance vs General Insurance (Quick View)

Life Insurance General Insurance

-

Covers death & savings Covers loss & damage

-

Long-term Short-term

-

Maturity benefit Claim-based only

📝 Simple Example

If your car meets with an accident and repair costs INR 50,000, motor insurance pays the amount (as per policy terms). Without insurance, you pay from your pocket.

Awards & Recognition

Our Partners

Testimonials

Our Happy customers say about us

When I was in need of money, the LIC policy I had taken out at a younger age than my friends helped me.

எனக்குப் பணத் தேவை ஏற்பட்டபோது, என் நண்பர்களை விட இளம் வயதில் நான் எடுத்த எல்.ஐ.சி பாலிசி எனக்கு உதவியது.

You will find the latest information about our company here. You will find...

You will find the latest information about our company here. You will find...